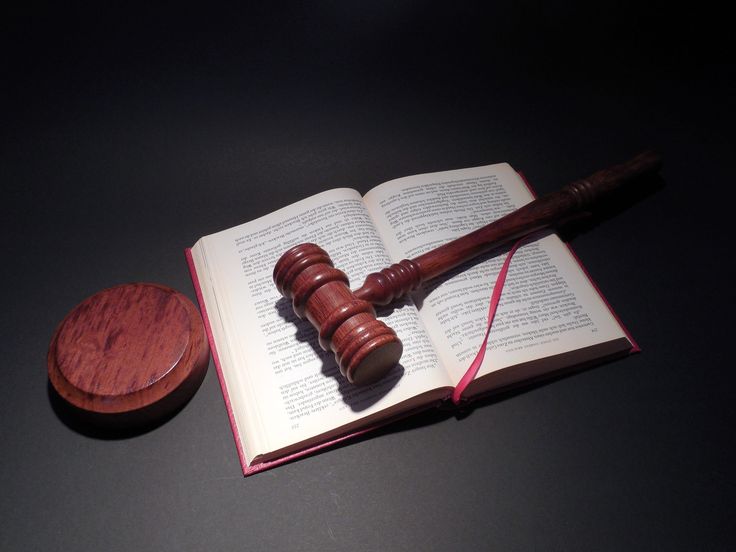

About GST Appellate Tribunal

The Goods and Services Tax Appellate Tribunal (GSTAT) has been constituted by the Government of India under section 109 of the Central Goods and Services Tax Act, 2017 to hear appeals against the orders passed by the Appellate or Revisional authorities under sections 107 or 108 of the said Act. The GSTAT has also been empowered to adjudicate or examine cases of anti-profiteering under section 171 of the Act. GSTAT, being a national Tribunal, has its Principal Bench at New Delhi and 31 other State Benches located in the States and UTs and will have sittings in 44 different locations across the Country. The Tribunal is headed by the President who is to be a Judge of the Supreme Court or a past/present Chief Justice of a High Court. Besides the President, the Principal Bench has three other Members- one Judicial Member and two Technical Members, See More

Statistics

Total

Registered Users

Total

Advocate Registered

Total

E-filed Appeals

Total

E-Filed Applications

Total E-Filed Appeals(Current Month)

Total E-Filed Application(Current Month)

Total Benches and Pull Values

GSTAT Facilities

Case Tracking

Case Tracking: Stay updated on the progress of your appeal at every stage.

Track Your Case

CIS Module

Case Information System (CIS): Ensuring meticulous scrutiny and efficient case management.

Learn More

DMS Module

Document Management System (DMS): Secure and instant access to all your case documents.

Access Documents

Notifications

Stay Informed: Receive instant notifications and alerts on case developments.

Set Notifications

Help and Support (e-Seva Kendra)

Need Help? Our dedicated support team is here to assist you with any queries.

Contact Support

User Guides and FAQs

User Guides & FAQs: Find answers and guidance to use the GSTAT Portal effectively.

View Guides

Security

Your Data is Secure: We prioritize the privacy and security of your legal documents and information.

Read More